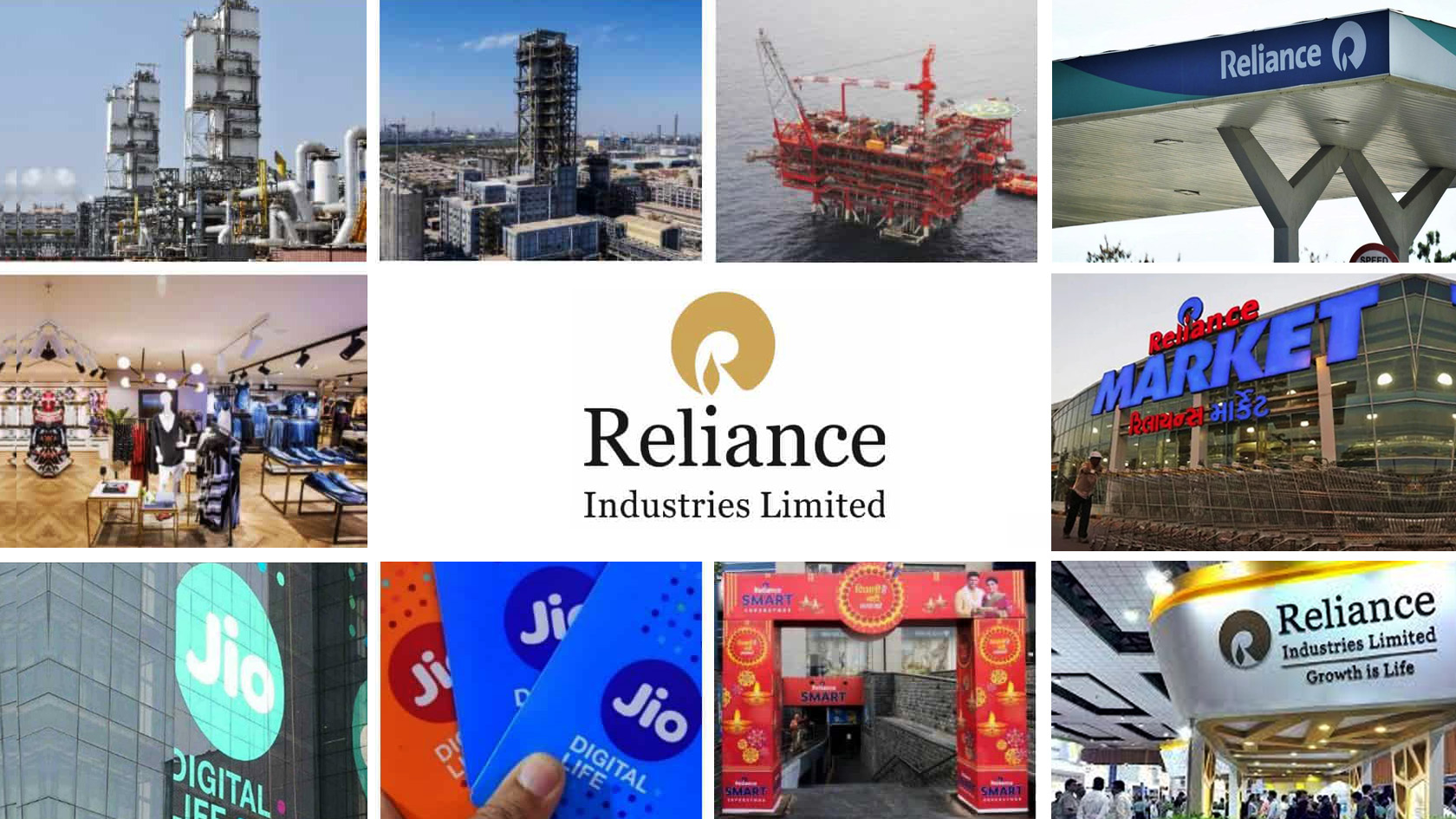

Reliance beats the estimates, profit boosted by Retails and Jio, although, the revenues decline 2.21% to 152,939cr from 156397 cr Dec 18 Q3.

Yet, it successfully beat the profit estimates to 11784cr (+ 13.8%) as compared to 10352 %cr in Q318 Dec.

Highest consolidated Q3 Net Profit reported ever.

Company’s accounted decline in revenue because of declining 6% fall in Brent price, which was partially offset by a continuing growth momentum in consumer businesses.

GRM can be a concern to few investors that invest on margin basis in petro biz. Because, company reported GRM of $ 9.2 per barrel for the qtr from $9.4 previous qtr.

But YoY basis, it was $8.8. Because of declining revenues in petrochemical, fell 19%. Company said already, it would take 12-18 months for petrochem prices ro improve.

Joint vc of 49% in petro retail with BP for billion dollar USD with purpose of expanding petro retail outlet to 5500 in five years has helped petrol retail sales, increasing the growth of 11% in diesel & 15% in petrol from current 1400 outlets.

Apart from the report card, company is unlikely to close the deal with Aramco (CFO report) by March end.

Deal is making a progress, the deal worth $15 billion by selling the 20% stake in chemical & refining business. The deal purpose is cutting the debt & secure an assured supply of crude oil to its refineries.

Company’s debt reduced in Dec Q3 to Rs 1.53 lakh cr from Q2 Rs 1.57 lakh cr. Company said in a statement that it targeted already to be debt free by FY2021.

Jio’s revenue increased 28% and reliance retail revenue increased 27% to Rs 45300cr.

JIO reported Rs 13968cr revenue, and net profit of Rs 1350cr. Increased their subscriber 370million, up 32% from last year.

One can draw conclusion out of this report is that company is not driven by only Petrochem biz, but with Jio, and reliance retails as it boosted the profit.

Key ratios Qtr Basis for short term.

EPS surges to 18.36 from 17.30 Dec 18 (cons basis)

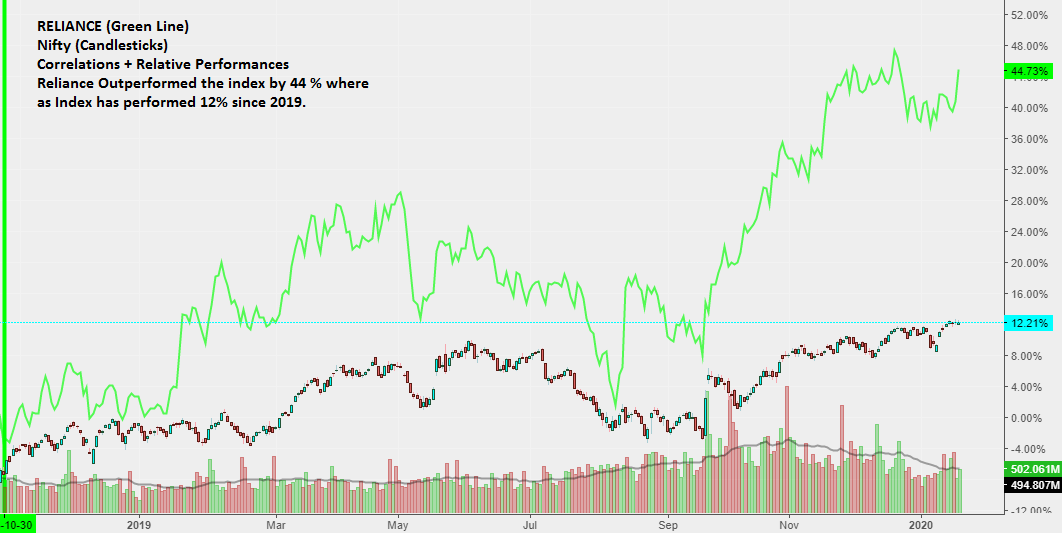

Charts

Reliance (Daily Chart, Green Line) + Nifty (Daily, Candlesticks) + RSA (Relative Strength Analysis)

We can see in this chart that how Reliance kept outperforming the Index since 2018 Nov.

As Reliance holds the highest weightage in the Index, It’s seems easy for Nifty to surge 12500-12600 for short term.

Reliance (Daily Chart) 2018 NOV – 2020 JAN

We can see in this chart as Reliance Continues the uptrend, EMA 100 crossed over EMA 160, making it golden cross since Nov 2018.

Clearly shows the target above 1650 to 1700 for long term perspective.

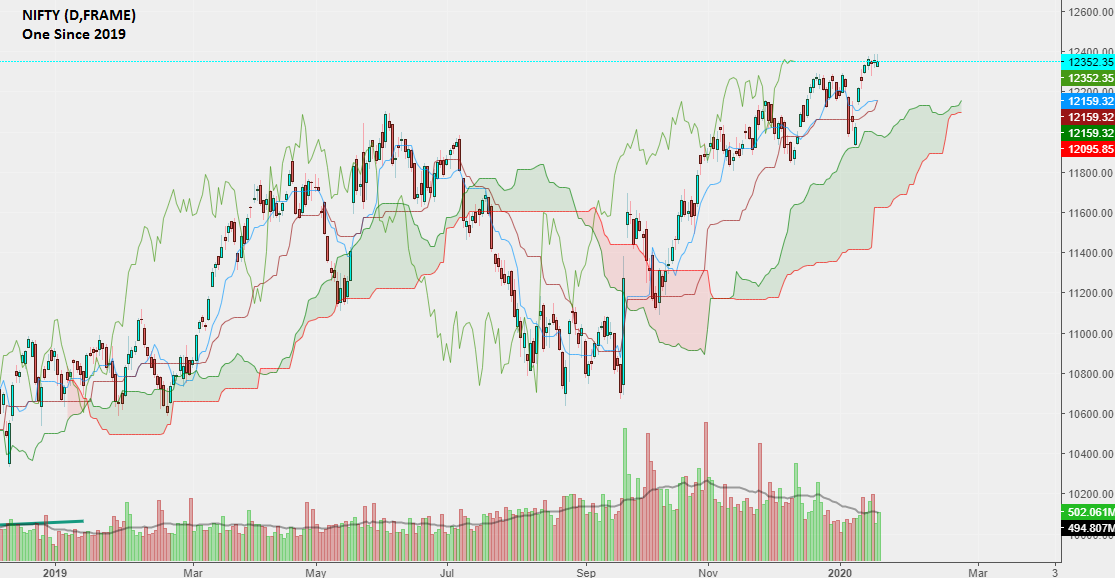

Nifty (Daily Chart) with Ichimoku Clouds.

For short term trend is up but Nifty can correct and stays in range of 12600 – 11850.

Reliance weekly chart.

Recent Support at 1500 – 1480, Headed towards 1650-1700 for short term perspective.

Author:

Leave a Reply

Your email address will not be published. Required fields are marked *