Nifty closed at 11754.65 on last trading session after sustaining the support at 11550, Market confronted the fear as Vix surged to 25 and fallen to 21.75.

In midst of election, we’re seeing Nifty composites surging 4% to 5% weekly average basis. In earnings season, as optimism over market and their estimates number are beating pessimists & bearish players.

And market data and other large cap stocks and their performances are all depicting a remaining rise towards 13000.

Global market are surging and trending up.

Dowjones30 Index surged 4.5% up from 25450 to 26580 in a month, which is why global market sentiment is positive.

S&P 500 Index surged 7.2% up from 2750 to 2950 in a month.

Nasdaq 100 Index surged to 11.9% up from 7010 to 7844 in a month.

So, where are the barriers?

We witnessed major rise in India Vix from 14 to 25, almost 150% rise in a month. We can expect uncertainty in market as fear and speculation plays at same time during general election, leading India Vix to 25.

Yet rising volatility failed to reverse the market trend & let momentum rise, and Nifty surges 8% up to 11750 from 10860 levels in a month. Nifty Bank also surges 13.5% up to 30770 from 27000 levels in a month.

For Investors, we believe market is bullish, but for traders point of view seems skeptical.

Last week, India Vix fell to 21.70 from 26.3 high, depicting bulls facing the bears, as FIIs were net buyer and market continues forming bullish reversal and closed at 11754.65 on last trading session.

Nifty formed continuation by confirming the support at 11550, and breaking the resistance 11710 to 11750 towards forming new high near 11850to 11900.

Nifty Bank formed support near 29440 to 29400 levels, continuing the trend towards 30700 to 31000.

So, what were the factors that led market up, ignoring the rising volatility & which one of them a leader from Nifty composites?

Let’s find out.

As we’ve seen many stocks like Tata steel, TCS, Ultratech Cement, Axis Bank, India Bulls Housing finance reporting their earnings with positive estimates, some of them beat their expectations and some of them were fair, Reliance Industry also posted fair number but their GRM falls, yet Reliance continued the trend towards 1450 level.

Nifty Composites that keep surging:

- TCS

- ASIANPAINTS

- AXISBANK

- BAJAJ-AUTO

- BAJAJ FINANCE

- BPCL

- GRASIM

- HCLTECH

- HDFC

- HDFCBANK

- ICICIBANK

- JSWSTEEL

- KOTAKBANK

- RELIANCE

In these stocks we witnessed long buildup and rising open interest, depicting traders are bullish and initiating long strategies for more positive expectations.

Let’s see their charts and forecast the remaining moves along with targets.

So where are we headed before general elections outcome?

Let’s see the Index & Nifty Composites Charts.

Chart 1. NIFTY Candlestick, 2hr Timeframe

Uptrend Continues in NIFTY50. No sign of retracing 0.382% levels near 11350. Instead, it’s going towards 11850 to 12k for short-term.

Negative divergence observed but price patterns confirming that divergence will last a little longer than correction.

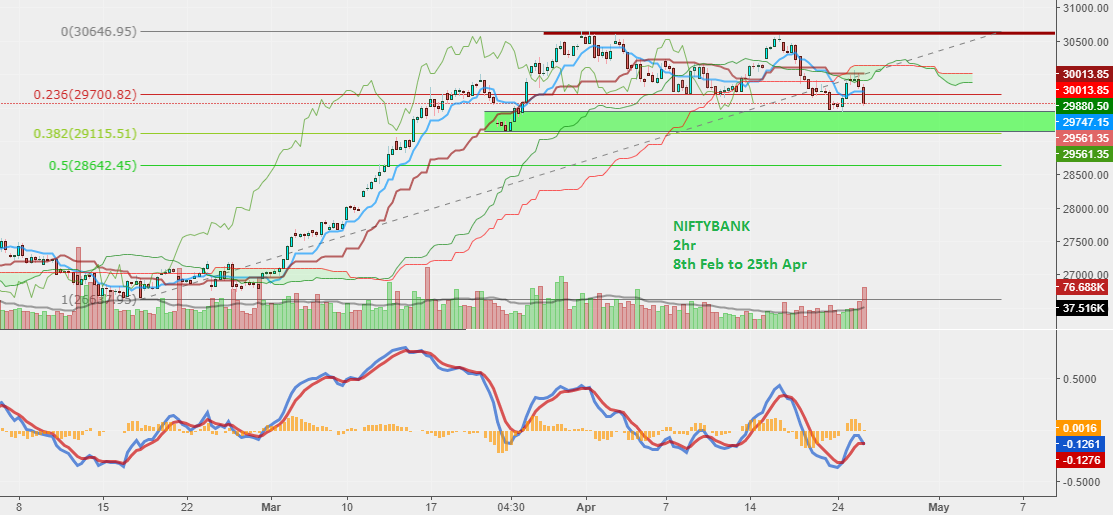

Chart 2. NIFTYBANK Candlestick, 2hr Timeframe

Uptrend Continues in NIFTYBANK. Negative divergence observed but price patterns confirming that divergence will last a little longer than correction.

Chart 3. TCS Candlestick, 2hr Timeframe

Uptrend Continues in TCS.

Chart 4. ASIANPAINTS Candlestick, 2hr Timeframe

Uptrend Continues in Asian Paints, rising channel shows mild correction though.

Chart 5. AXISBANK Candlestick, 2hr Timeframe

Correction expected but stock is in uptrend.

Chart 6. BAJAJ-AUTO Candlestick, 2hr Timeframe

Uptrend Continues in BAJAJ-AUTO.

Chart 7. BAJFINANCE Candlestick, 2hr Timeframe

Uptrend Continues in BAJFINANCE.

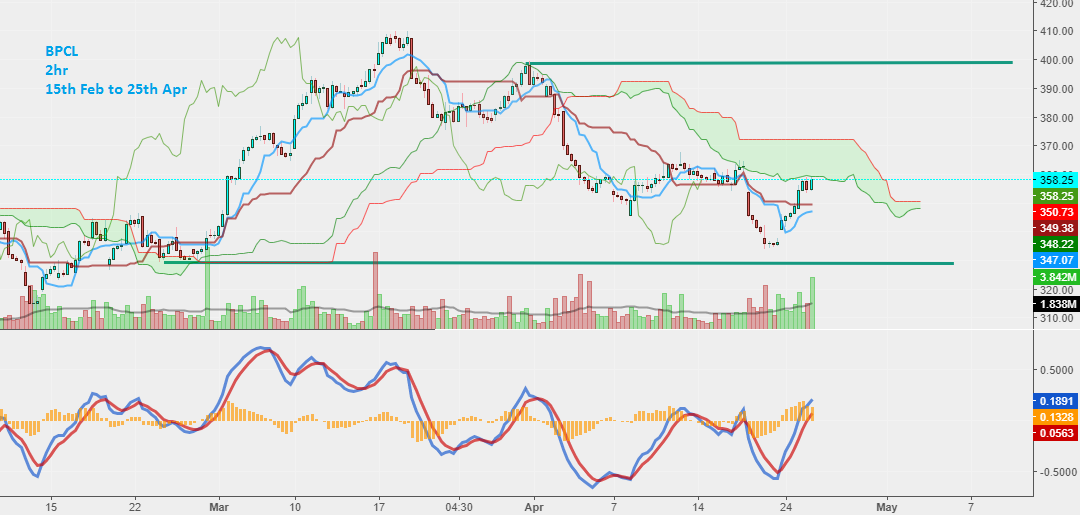

Chart 8. BPCL Candlestick, 2hr Timeframe

Expects rise to the level at 400 up from support at 330.

Chart 9. GRASIM Candlestick, 2hr Timeframe

Continues uptrend in GRASIM.

Chart 10. HCLTECH Candlestick, 2hr Timeframe

Continues uptrend in HCLTECH.

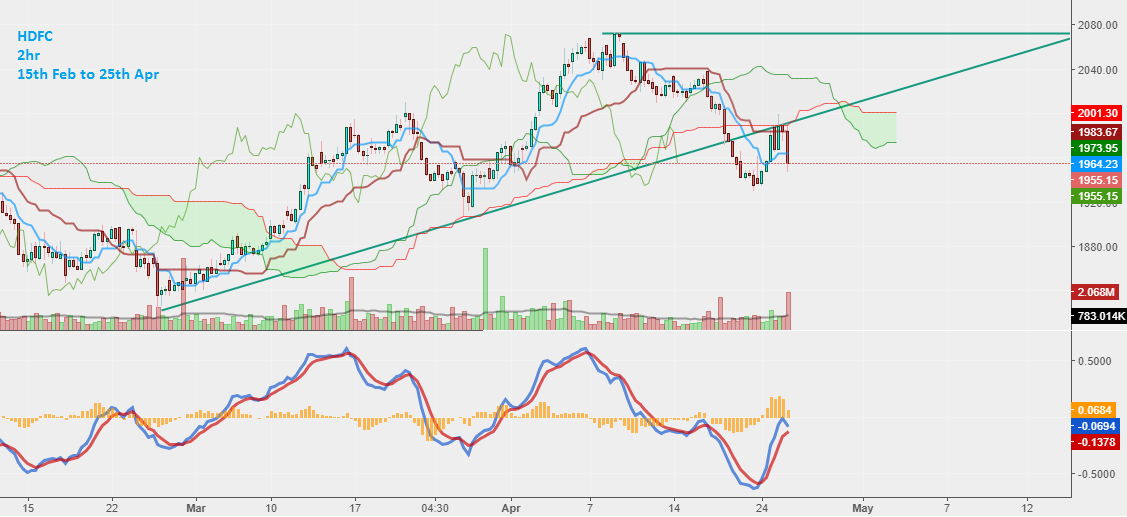

Chart 11. HDFC Candlestick, 2hr Timeframe

Continues uptrend in HDFC after Fibonacci retracements, Expects price to test 2080 to 2100 levels.

Chart 12. HDFCBANK Candlestick, 2hr Timeframe

Continues uptrend in HDFCBANK, Expects price to test 2360 to 2370 levels.

Chart 13. ICICIBANK Candlestick, 2hr Timeframe

Continues uptrend in ICICIBANK, Expects price to go above 415.

Chart 14. JSWSTEEL Candlestick, 2hr Timeframe

Expects mild correction as negative divergence in play. But uptrend will continue.

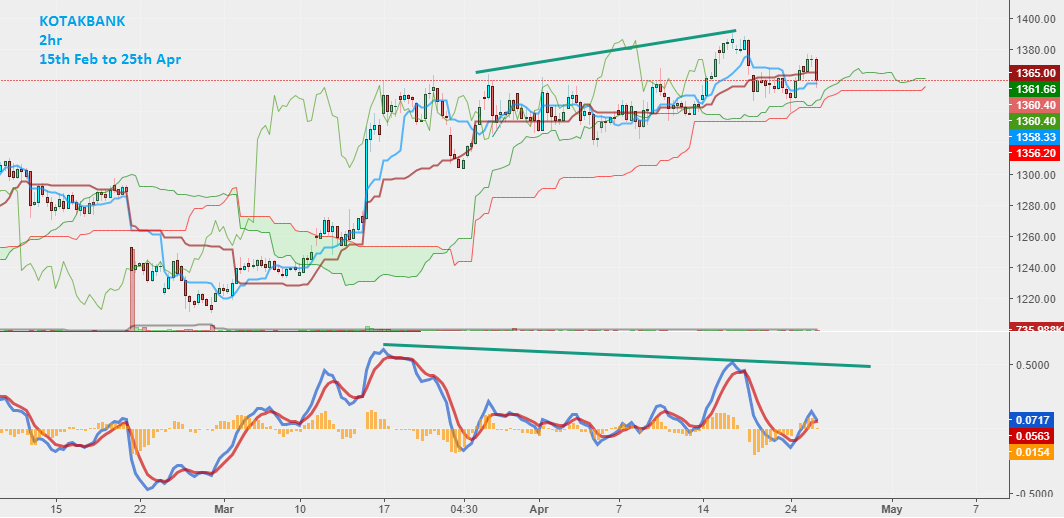

Chart 15. KOTAKBANK Candlestick, 2hr Timeframe

Continues uptrend.

Chart 16. RELIANCE Candlestick, 2hr Timeframe

Continues uptrend.

Conclusion:

Nifty50 Uptrend continues, headed to 12500 to 13000 levels for short term, as composites are moving in favor of bull.

1st may FOMC will release interest rate decisions. Global market sentiment is positive and S&P making new high day by day. NASDAQ is also making new high every day.

All data recommends bulls in control and leading world to new high

Author:

Leave a Reply

Your email address will not be published. Required fields are marked *